THE AFRICAN INTERNET ECONOMY IS ONE OF THE LARGEST OVERLOOKED INVESTMENT OPPORTUNITIES OF THE PAST DECADE WITH POTENTIAL FOR PROFOUND IMPACT ON DEVELOPMENT

The mobile Internet is transforming life across the African continent with the support of growing local connectivity and mobility and a dynamic, young urban population. With a potential to add up to $180 billion to Africa’s gross domestic product (GDP by 2025, depending on the usage intensity of digital technologies by businesses, the Internet economy is improving productivity and efficiencies across large swaths of the economy, including agriculture, education, financial services, healthcare, and supply chains.

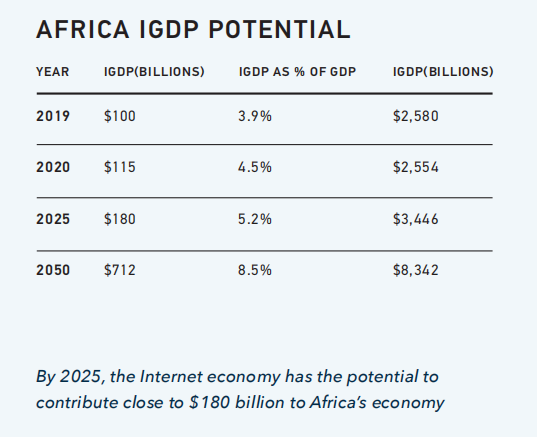

BY 2025, THE INTERNET ECONOMY HAS THE POTENTIAL TO CONTRIBUTE NEARLY $180 BILLION TO AFRICA’S ECONOMY

THE COST OF INTERNET ACCESS AND THE IMPACT OF RISING DEMAND

Affordability is a primary barrier to mobile Internet access.

Entry-level and secondhand devices have prices ranging from $35 to $40 which is the equivalent of up to 80% of monthly wages in some African countries. Affordability levels exceed the global 2% of monthly income target in more than 75% of countries in Sub-Saharan Africa, largely due to the high import cost of devices. Asian brands account for 70% of the African mobile device market, with the Chinese-owned Transsion leading in volume. As local phone manufacturing grows and structured payment plans become more prevalent, smartphones are expected to become more affordable and available.

There has been significant progress in reducing the cost of data over the past few years.

Tariffs have dropped from 13.2% of average monthly income to 6.8% between 2016 and 2019. As governments continue to implement mandates and the supply of mobile devices continues to grow, Internet access will become more widespread and affordable.

There is an increasing demand for high-speed Internet and digital services.

While the majority of mobile connections in Africa are slower-speed 2G connections, 3G broadband connections are predicted to account for 54% of all connections by 2025, with 4G connections reaching 31%.48 Fixed broadband has also grown 15% annually since 2015 and is expected to triple by 2023.

Monthly data consumption is forecasted to increase by over 300% between 2018 and 2024.

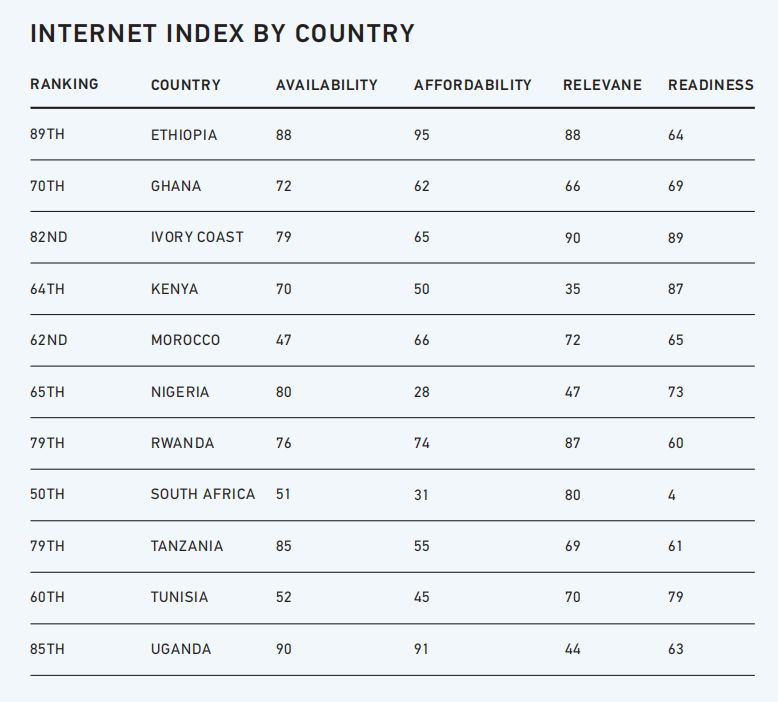

This will lead to a higher demand for faster and more reliable Internet. In addition, digital readiness will also need to increase in order to help drive usage more widely, requiring the development of content in local languages and educational initiatives for digital literacy skills. Based on The Inclusive Internet Index, South Africa, Tunisia, Morocco, Kenya, and Nigeria are currently best positioned for thriving Internet economies.

THE SIZE OF AFRICA’S INTERNET ECONOMY

Market leaders are driving innovation in Africa across emerging verticals, such as fintech, healthtech, media and entertainment, e-mobility and food delivery, and B2B e-Logistics. Over the past decade, Africa’s Internet gross domestic product (iGDP) —defined as the Internet’s contribution to the GDP— growth has been strong.

In 2012, less than a decade ago, Africa’s Internet economy was estimated at roughly 1.1%, or $30 billion, of its GDP. An analysis conducted by Accenture found that iGDP may contribute approximately $115 billion to Africa’s 2.554 trillion GDP (4.5%) in 2020, up from $99.7 billion in 2019,52with a potential to grow as the economies gradually develop. By way of comparison, in developed economies like the US, the Internet economy contributed to 9% of GDP in 2018.

Over the next five years, COVID-19 is expected to delay economic growth both in Africa as well as in the rest of the world. However, despite these headwinds, Accenture’s analysis suggests that by 2025, the Internet economy has the potential to reach 5.2% of the GDP in Africa, contributing almost $180 billion to Africa’s total GDP, with low-income countries likely to remain below and middle-income countries expected to slightly exceed that average

After a period of economic recovery, Africa’s iGDP should continue to grow from 2025 onwards as the remaining 38 countries catch up to the 16 early-adopting ones mentioned above. So, while COVID-19 will be a shock to the economy in the short term, the underlying factors of Africa’s strong Internet economy will not only remain the same but strengthen. The resilience of the Internet economy coupled with investments in infrastructure, private consumption, strong developer talent, public and private investment, and new government policies and regulations will continue to drive this growth in Africa.